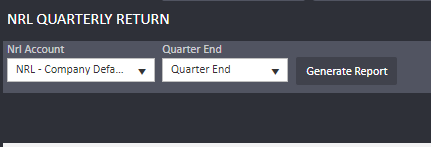

For landlords who have NRL status, you will periodically need to refer to the annual and quarterly reports for NRL returns.

You will find reports under the accounting tab labelled "NRL Quarterly" or "NRL Annual" return.

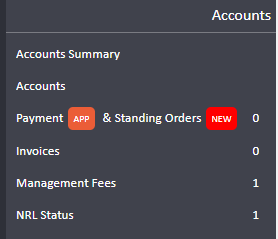

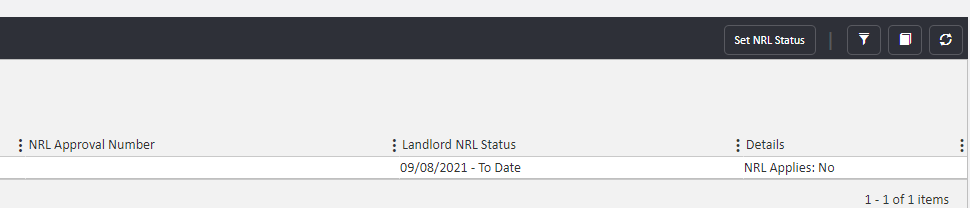

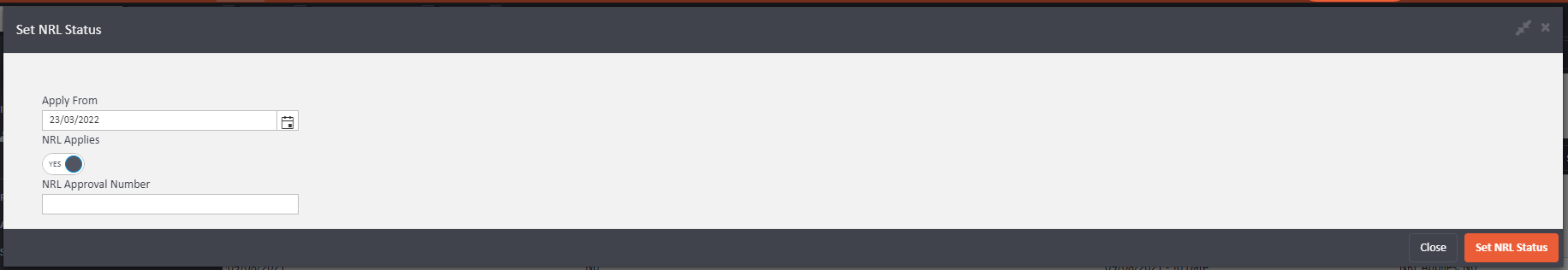

Before we talk about the NRL Returns, you should be aware that the way in which you indicate a landlord to be NRL, you would go to the Landlord Profile > NRL Status to the left on the ladder bar, then set the status to be NRL applies.

Tick the box for NRL Applies and only add an approval number if your NRL Landlord is exempt for the Tax deductions.

The system will calculate everything for you automatically based on what you enter.

To find these reports, you will find them under the accounting tab.

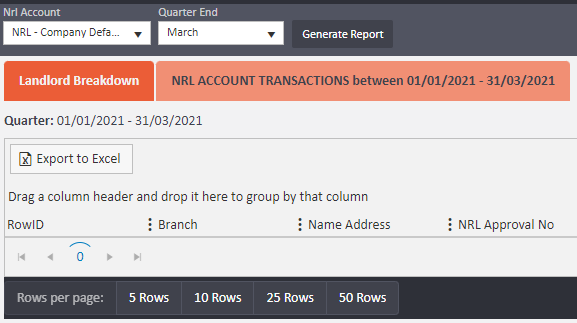

Once you have selected one of these reports then you will have to select a year end or a quarter end date in the filter bar at the top of the page.

You will then need to click on 'Generate report'.

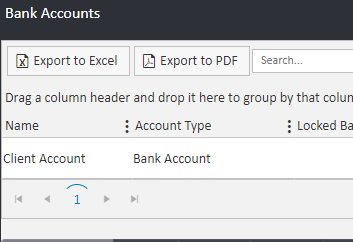

To do an NRL draw-down of the funds collected, you must go into the NRL Draw-down section which is the upper right hand side of the Bank Accounts section. Please click onto the Accounting tab followed by the Bank Accounts icon. Now click onto your bank account.

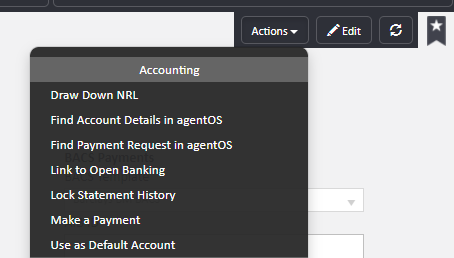

There will be an Actions button to the top right of the page. Please click onto the areas as shown to be highlighted below to reach the NRL draw down.

Comments

0 comments

Please sign in to leave a comment.