*Please note, the SAS report runs from 6th of April to the 5th of April each tax year. This report will include all system processes(Maintenance, Charges/Refunds - automated from Management Fees, Auto Charges or Manual Charges, Rent in and payments to the landlord.)

Journal Transfers or Transfers between people. If you feel transactions are missing, check via the landlords 'Accounts' on their profile for the time the action was applied. It is likely it was either before the cut off or falls under a Journal or Transfer.

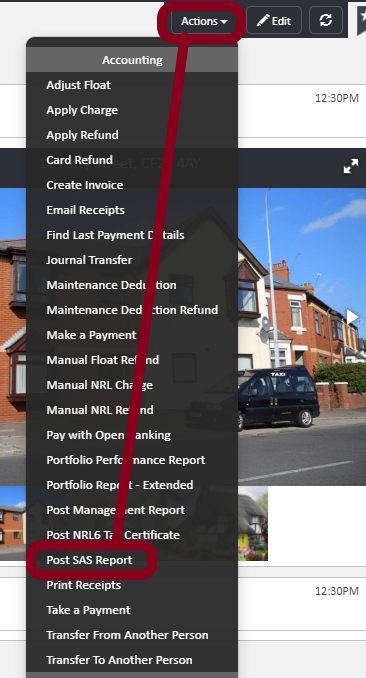

To produce and send a landlord' self assessment report please go to the landlord profile first > Click Actions in the top right > Post SAS Report

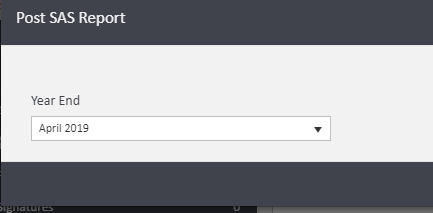

Select the year end and send to postbag by selecting the option for "Post SAS Report" on the bottom right

Comments

0 comments

Article is closed for comments.