Features

Anti-Money Laundering (AML), ID, and Right to Rent/Work Checks

We've added the ability to run Anti-Money Laundering, ID, and Right to Rent/Work checks through agentOS, in conjunction with Credas (charges apply).

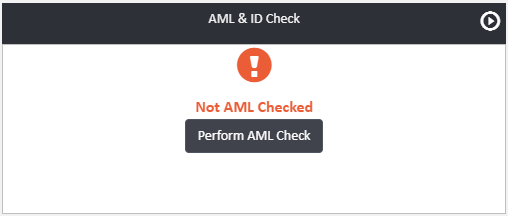

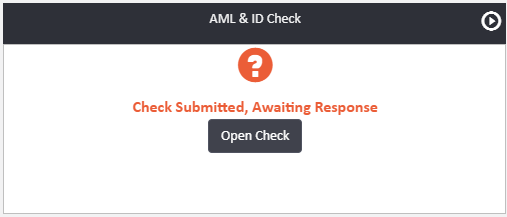

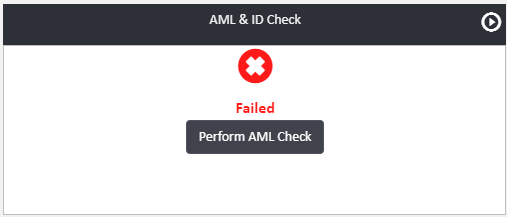

On the Infographics pages of landlords, applicants, tenants, contractors, buyers, and vendors you'll find a new AML & ID Check widget, where you can begin a check for a person you've not checked before, open the details of an ongoing or completed check, and also see the overall status of that check at a glance. In most cases you'll see one of these statuses from here:

On the top-right of this widget you'll find a Play button, with a link to the video below, explaining how the service works, and what your clients can expect to see when receiving a request to complete a check.

This new widget will also appear in the Action on a person's profile for Make a Payment, and in the Pay People in Credit list in your Bank Account.

You can also begin a check by using the option under the person's Actions for AML & ID Check. This is also the main way to start the check process for people on the system who don't have an Infographics page, like Solicitors or Developers, for example.

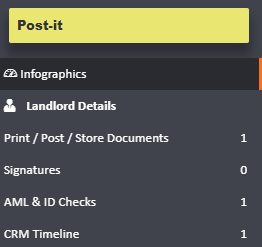

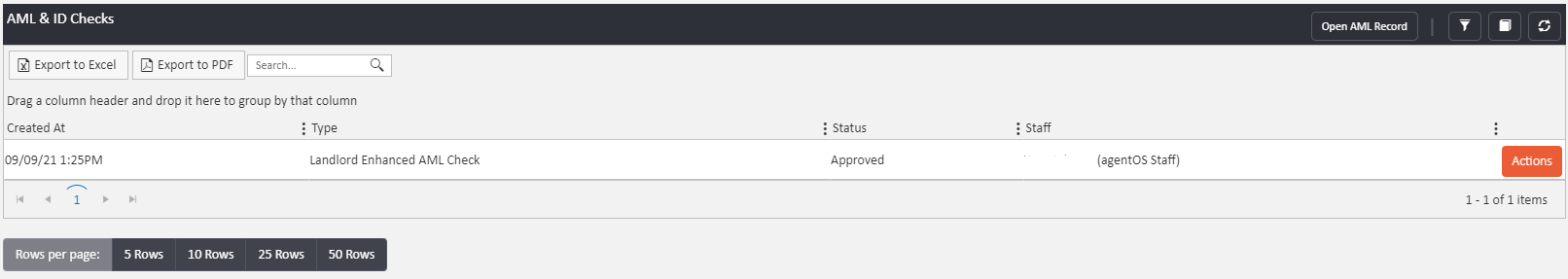

You'll also see a new section in the left-hand ladder of all person profiles, titled AML & ID Checks, where you can click in to see the status of ongoing or completed checks:

You can click into an individual check to see more information about its status, and the details shown here will regularly update with the latest information from Credas. Checks can also be cancelled from this menu using the Cancel option.

Notes (on the left) will show any changes that have taken place, and once a check has been completed, the PDF report will appear under Documents on the left, showing what your client has submitted as part of the check.

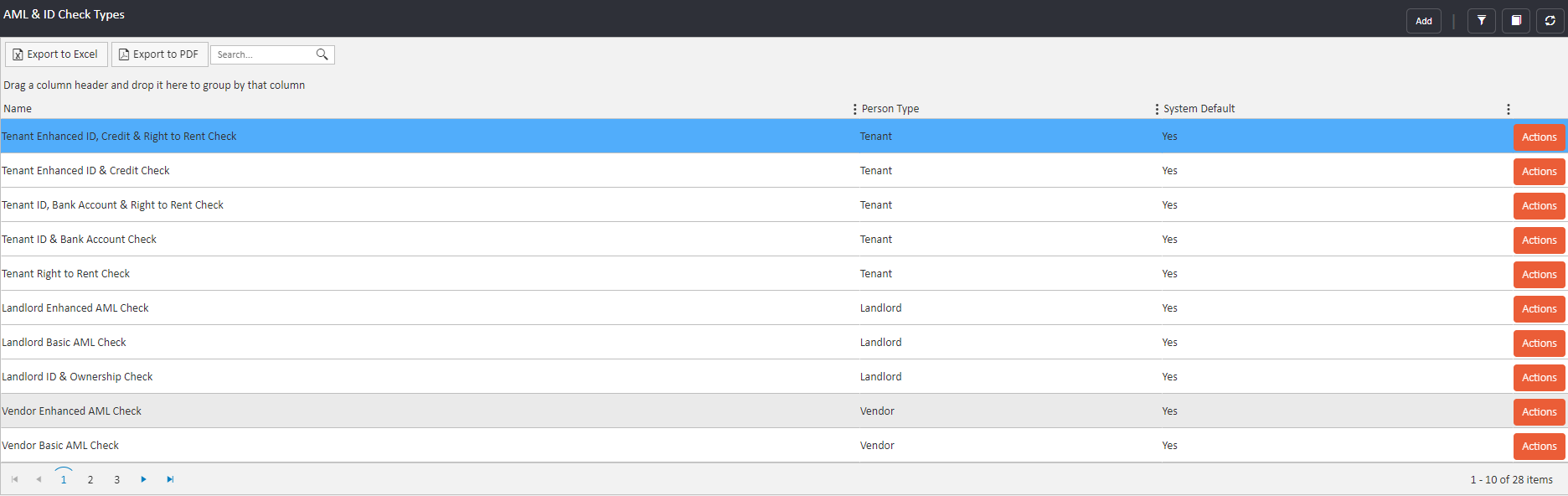

Check types are listed as a new option under the Object Types menu for AML & ID Check Types. Here you can see a list of the standard system types:

Please note - standard check types cannot be amended.

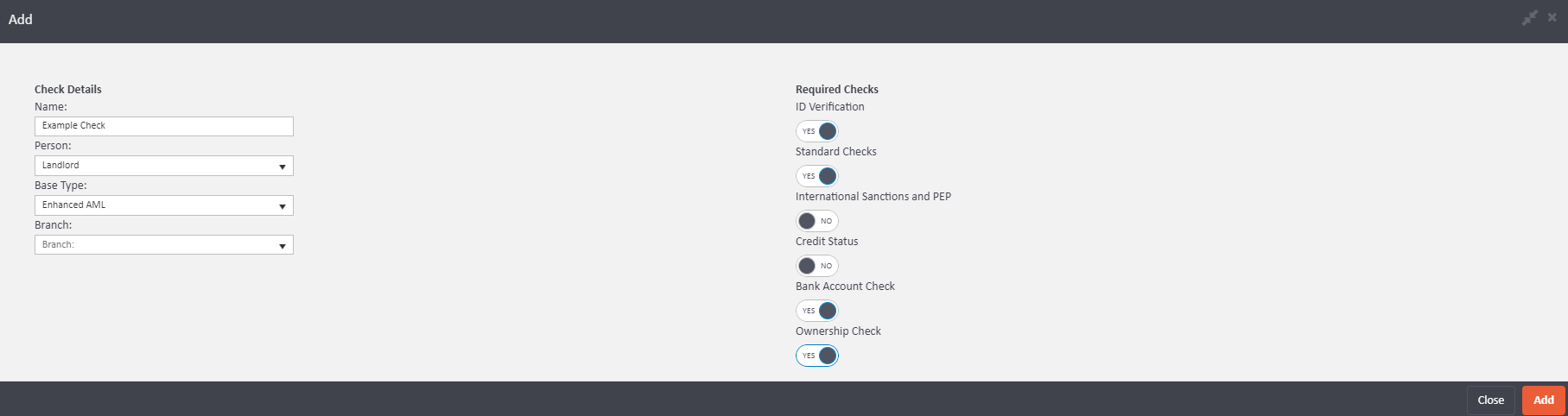

On the top right of this menu, you'll find an Add option, where you can add your own custom check types. The menu here will allow you to Name your check type, choose the Person type the check will be conducted on, and a Base Type for the check. If your check relates to a specific Branch only, then this can also be selected on the left. The specific check types that you'd like to include can then be selected with the sliders on the right-hand side:

Please note - ID Verification is a required option on all custom check types.

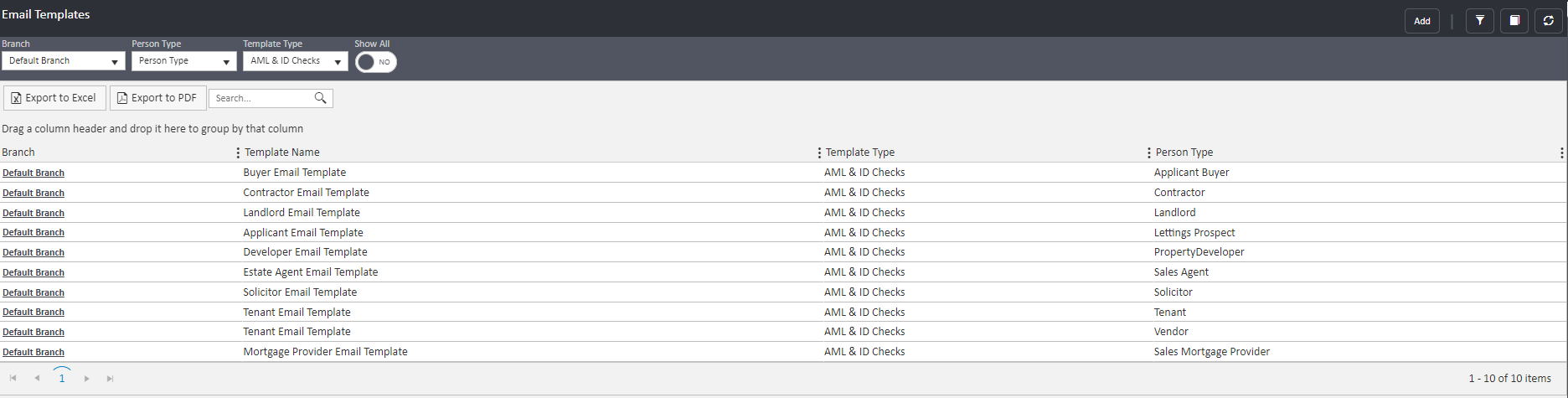

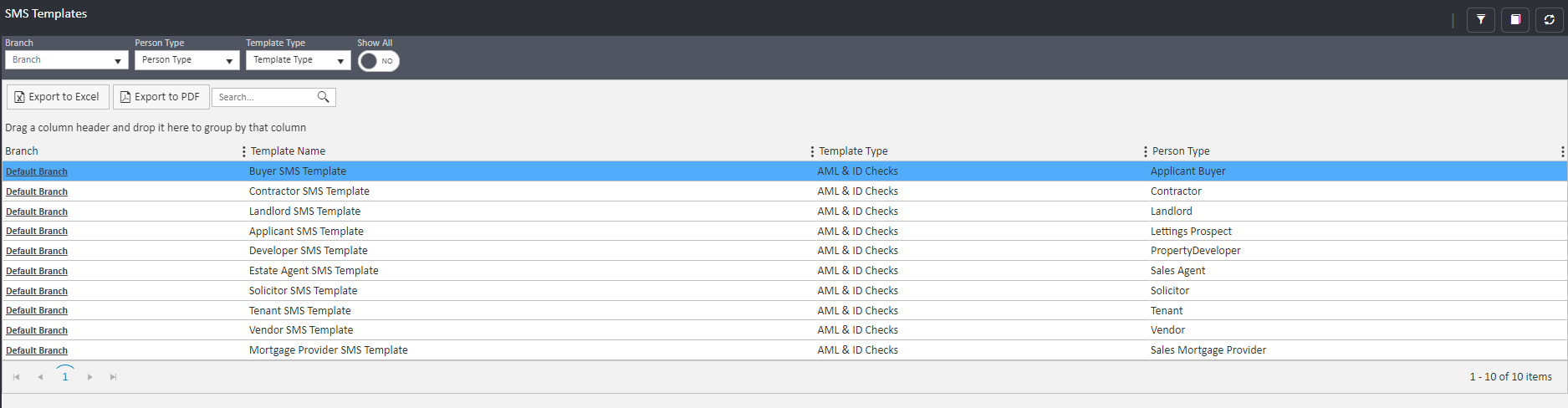

Email and SMS templates can also be customised for the new AML checks, and for this we've expanded the existing option under Office for Email Templates, as well as adding a new option to this section for SMS Templates:

Email Templates now include options for AML & ID Check email wording, and comes with a standard wording for each person type, which can be amended as required by clicking into the template and using Edit.

You can also add additional custom email template types by clicking the Add button on the top right.

The SMS Templates section works in a similar way, with standard wording for each person type available that can be amended as required.

Further work will take place on this section in a future release to allow additional custom types to be added, and for this section to be expanded to include SMS template types from other parts of the system.

Please note - the registration code and links that your client will need in order to complete their check will automatically be added to the end of your Email or SMS Template wording.

On the main Dashboard, we've moved some items under Prospecting and Sales & Lets to allow us to add additional fields for you to see which people are still in need of an AML or ID check. The four new fields are:

- Prospecting: AML Checks - Vendors not checked

- Prospecting: AML Checks - Landlords not checked

- Sales & Lets: AML Checks - Buyers not checked

- Sales & Lets: ID Checks - Tenants not checked

These fields will show you any Vendors, Landlords or Buyers with outstanding AML checks that are involved with a new Sales Instruction or Tenancy that is within 60 days of creation and at the Advertised/Let Agreed stage.

These options click through to a report which will give you the details of who still requires a check. You can also access this report directly through Office under Outstanding AML & ID Checks.

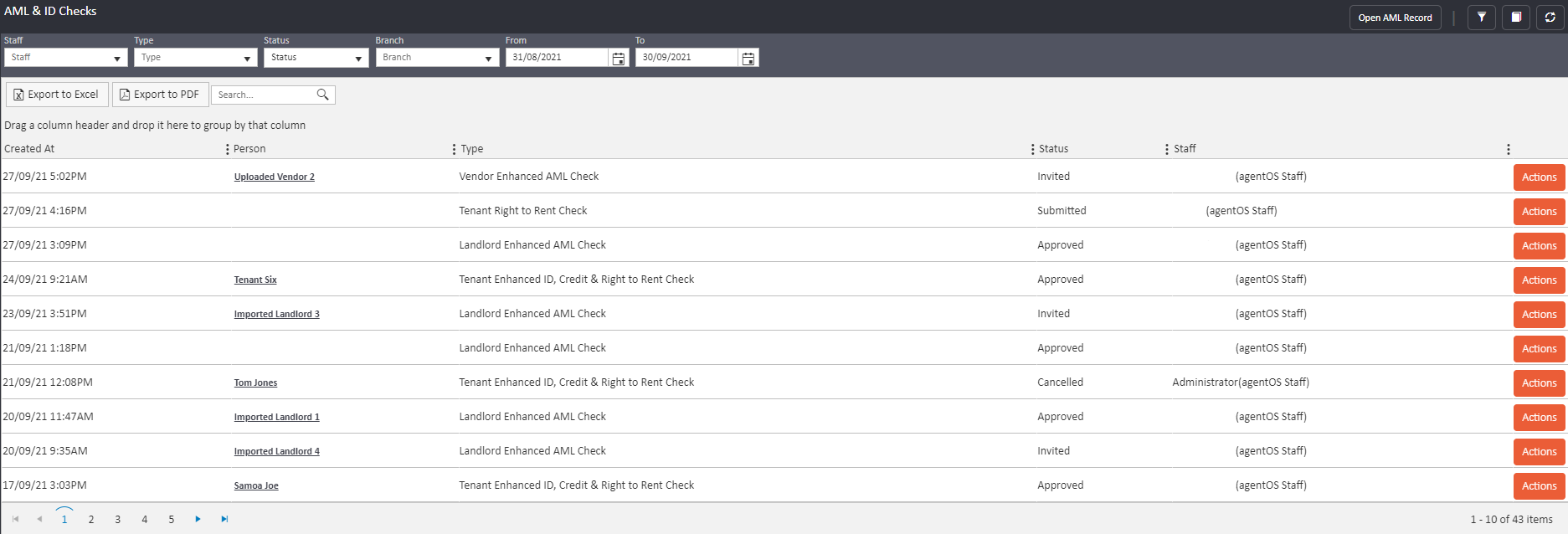

An overview report showing the AML and ID Checks you've ordered and their statuses can be found in Office under AML & ID Checks:

This report will show the date and time, the person being checked, the type of check conducted, the status and the member of staff who has ordered the check. (Please note that some names have been removed from this screenshot, but will appear for you).

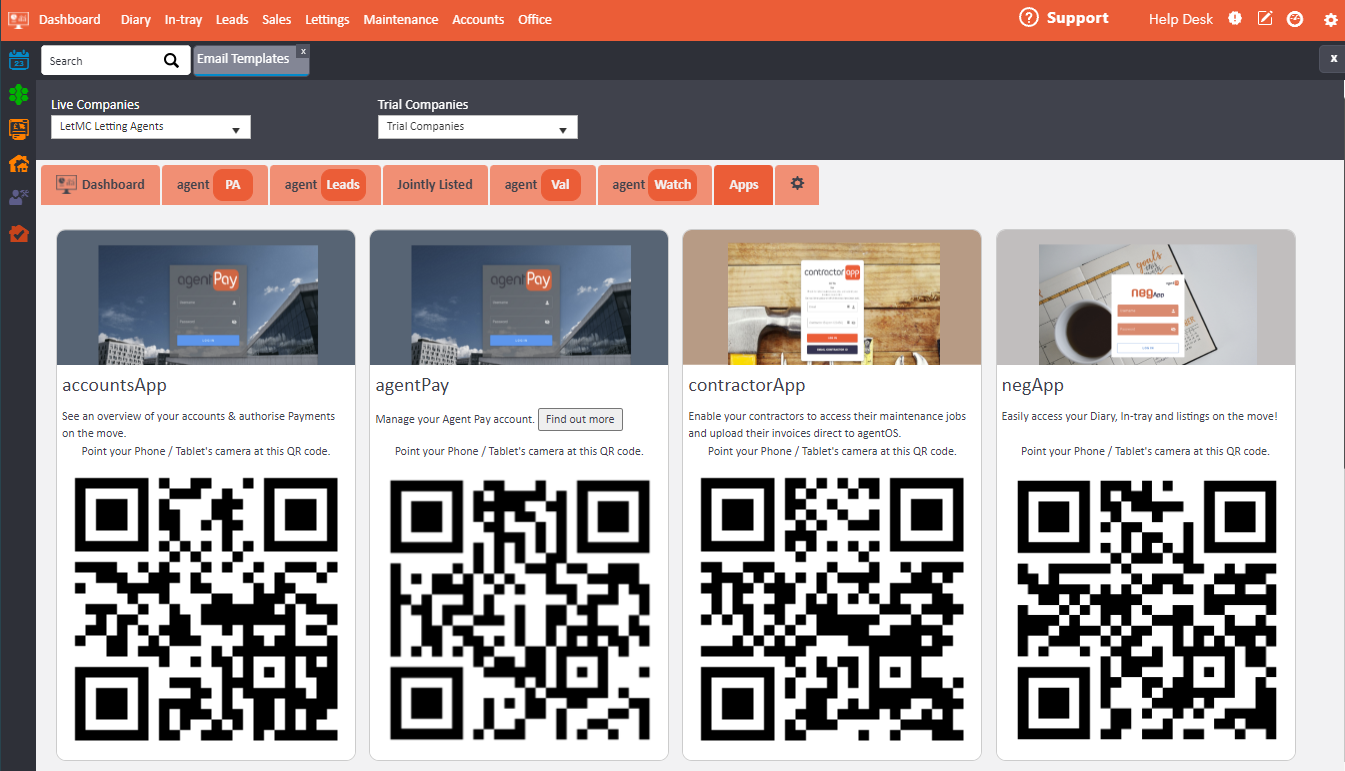

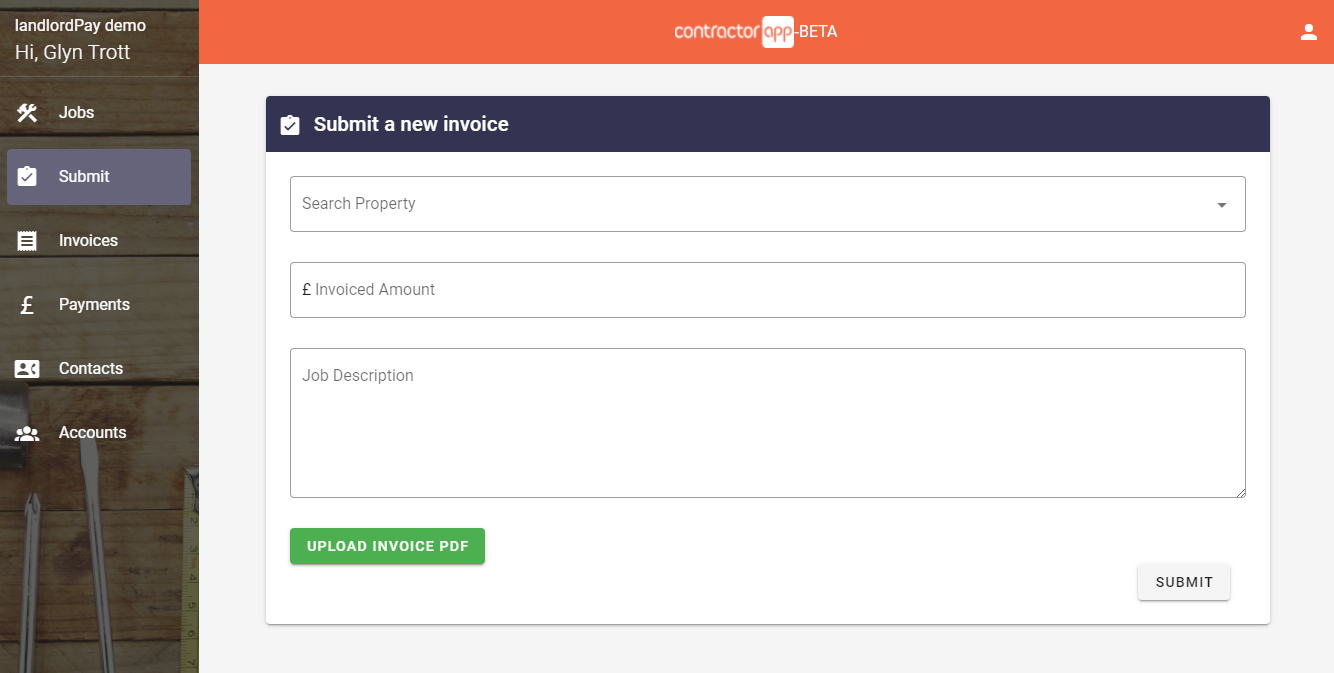

ContractorApp

The ContractorApp is out of beta testing and live, and you can find the link on the Apps tab:

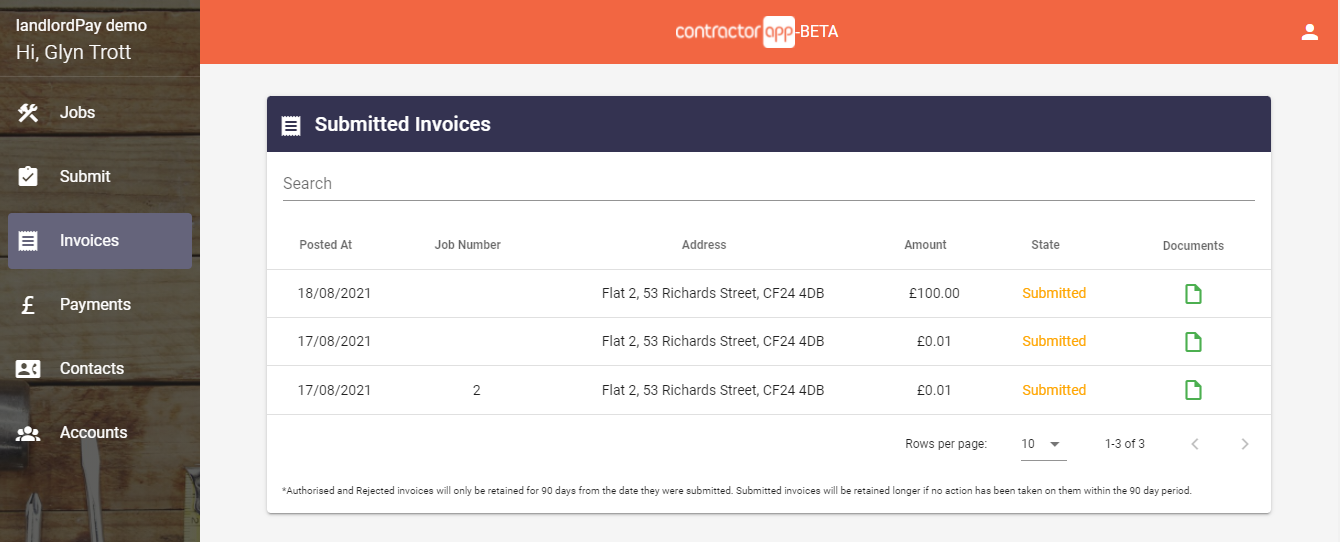

This App gives your contractor access to their maintenance jobs, account (including paid and unpaid invoices), as well as the ability to upload their invoices to agentOS.

For your contractor to access the app they click https://contractor.agentos.com and enter the email address you have on agentOS for them, and they will receive a code to open their account.

We recommend you create a custom email template sharing the ContractorApp link, and add it to your maintenance job sheets and email footers.

For further details please visit https://letmc.zendesk.com

https://contractor.agentos.com/

Improvements

Include in Invoice Print option for Submitted Invoice documents

- Added the Include in Invoice Print option to documents uploaded in Print/Post/Store Documents within a Submitted Invoice.

Offer Fallen Through Reason on Sales Offers

- A new field has been added to sales offers, allowing you to specify an Offer Fallen Through Reason. When using the option on an offer for Accepted Offer Fallen Through, you'll see two new fields, Reason and Note.

- The Reason field links to a customisable list available in the Object Types menu under Sales Offer Fallen Through Type, which has the following set types:

- You can Add your own custom types to this menu as required.

- The Note field is freeform and will record any additional details you'd like to include in the offer Notes.

Maintenance Job grid speeds

- Improvements have been made to the speed that the Maintenance Job grids load where there are higher volumes of jobs.

Metro Bank Statement Uploads

- Two new bank statement upload types have been added for Metro Bank 2021 and Metro Bank Commercial.

Bugs/Defects

Payment Groups

- Fixed a bug where some clients using Open Banking were unable to delete payment groups.

Unsubscribe link on Buyer property emails

- Updated the Unsubscribe link generated in some property emails to buyers to the correct details.

'File Not Found' when accepting a Maintenance Job

- Fixed a bug where a File Not Found error was being generated on maintenance jobs with some SSL document types attached.

Beta Testing

The following items are currently undergoing beta testing and are not yet available to most clients, so you may not see some or all of the sections referenced here yet. Please look out for communication from our Support and Growth teams for more details on when these will be available for use.

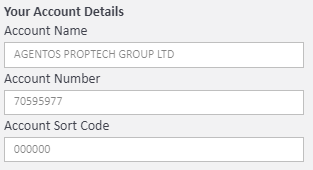

agentOS Client Accounts

AgentOS will be launching a new service that can provide agents with client bank account for agents who have been refused a new client account or have had their existing client account converted to a business account which consequently means they are not compliant with CMP insurance.

In addition to providing a built in agentOS faster payment service that is similar to BACS payment services:

- New buttons have been added to the top-right of the Bank Accounts section in Accounts, with options to open an agentOS Client, Bond or Trading account:

Please contact our Support team prior to adding your first account, as they need to set up your details on the banking system before you can proceed.

Please contact our Support team prior to adding your first account, as they need to set up your details on the banking system before you can proceed. - Once you've named your account and confirmed it will be created in the background, agentOS will open in a new tab automatically.

- The account details will be shown on the bottom left of that screen and are ready to use - you can give these to your tenants and others to use straight away:

- To grant yourself access to use the new account go to the agentOS Fast Payment Staff Access option from the left-hand ladder. From there you can Grant Access using the right-hand button to either yourself or another member of staff. This will generate a QR code, which you'll need to scan in an Authenticator app, such as the ones offered by Google or Microsoft - you can download these for free from your phone's App Store or Google Play Store if you don't already use one. Each time you make a payment from the account, it will prompt you to enter a code generated by the Authenticator app of your choice.

- Please note that you can only get this QR code when first granting access, so make sure you or your colleague has their Authenticator app ready to scan.

- New Make agentOS Fast Payment options using your new accounts are available from the individual Actions of people records, and also from the Draw Down Paid Sales and Pay People in Credit menus on the account in question:

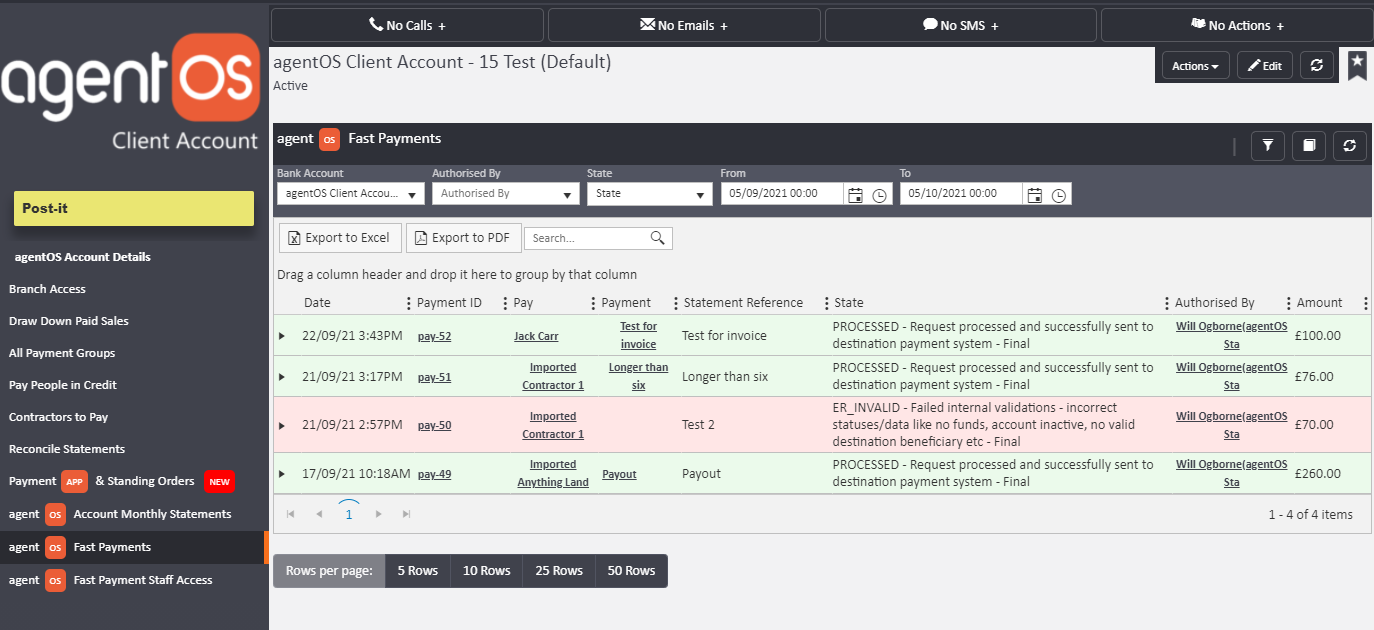

- An agentOS Fast Payments menu is also available from the bank account menu, designed to show you the statuses of any ongoing and completed payments. If any payments couldn't be made, you'll see the details listed here:

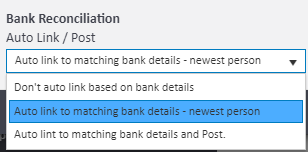

- In terms of statement entries appearing to reconcile, you can set your account to work in one of three ways. You can manually link any payments to people on the system in the same way as the accounts at present, you can have those entries appear linked but not posted, or you can have them automatically linked and posted to the newest record the system can identify that matches the person making that payment to you:

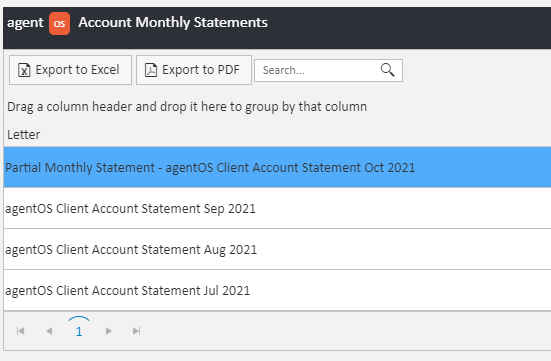

- Statements of the account are available from the agentOS Account Monthly Statements ladder option, and will include downloadable PDFs of both full previous months and a partial monthly statement for the current month, updated to the close of business for the previous day:

Bank Details/Confirmation of Payee (COP) Checks

A new widget has been added to the Infographics pages of Landlord, Tenant, Contractor, Vendor and Buyer profiles, to allow you to run Bank Details or Confirmation of Payee checks on that person's bank account details. This is designed to help you ensure that any payments made to that person are going to the correct bank account.

This new widget will also appear in the Actions on a person's profile for Make a Payment, and in the Pay People in Credit list in your Bank Account.

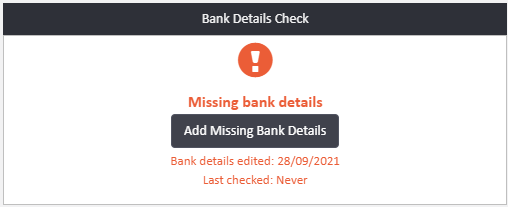

Any new person of these types that you add to the system without bank account details will show this widget to begin with, prompting you to Add Missing Bank Details:

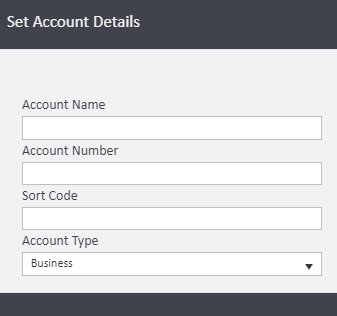

Clicking through will give you this pop-up, where you can add the details, and using a new Account Type field we've added, specify whether the account is a Business or a Personal account:

The Account Type field is also available in the existing Bank Details sections you can find in those person profiles.

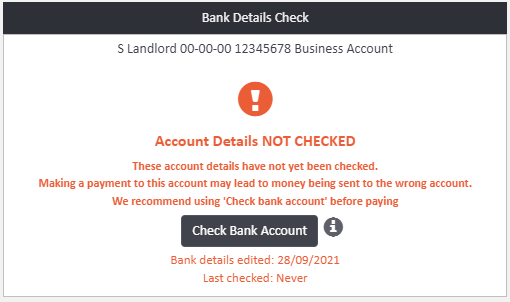

Once the details are added, or if you've added details a different way but are yet to check that person, you'll see this widget:

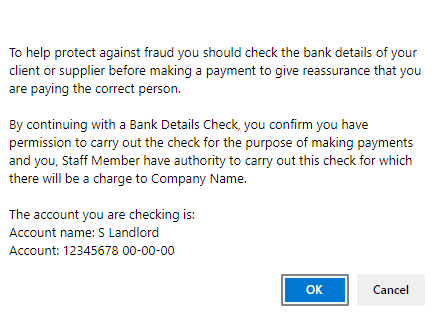

Click Check Bank Account to begin the process, and you'll see this pop-up warning. Please take time to read the details here before proceeding:

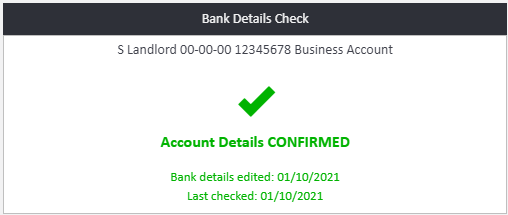

If the check passes, you'll see this updated widget showing the details as confirmed:

If the result is a close match, like you've entered the details as Personal and the check has found it's actually a Business account, then you'll see a widget similar to this one:

In these instances, you can use the option here to Fix Using Found Details and re-run the check using the updated account information.

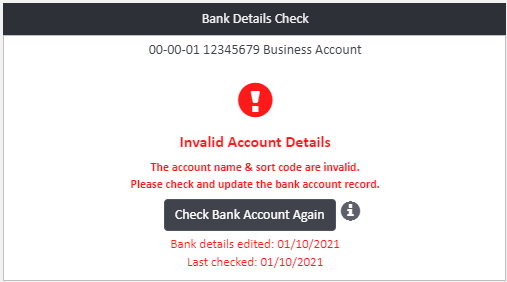

If the bank account details you've entered cannot be found, then this widget will show:

You'll be able to make changes to the details by clicking to Edit that person's profile and updating the Bank Details from there, before being able to run the check again.

For existing person records on your system, you may also see a Historic status shown. This is to indicate that the record pre-dates this new feature being added to agentOS, and although you may wish to run a check on those bank account details for your peace of mind before paying there is no requirement to do so.

Please note: any changes made to a person's Bank Account Details after a check has taken place will prompt agentOS to ask for a new check to be run, to prevent incorrect check details from being returned for a different bank account.

Payment App & Standing Orders

We've added the ability to request both one-off and standing order payments from your clients, using either agentOS itself or our new app, payAgent.

In agentOS, the existing Standing Orders section on person profiles has been merged into a new ladder option, Payment App & Standing Orders. In here you'll still see any previous standing order references that you've linked, but above that section is a new feature for requesting payments.

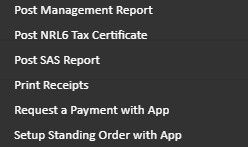

On the right-hand side of this new menu, you have options to Request a Payment with App, and Setup Standing Order with App. These are also available from the Actions menu of that person:

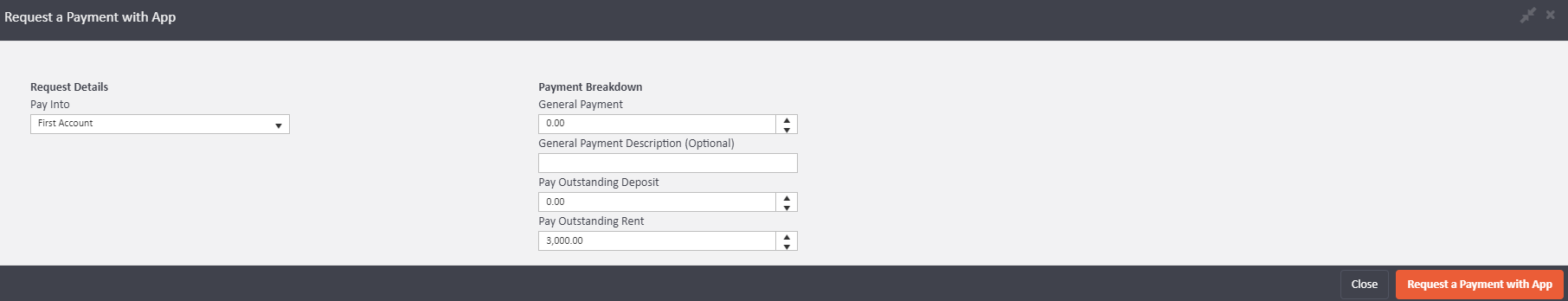

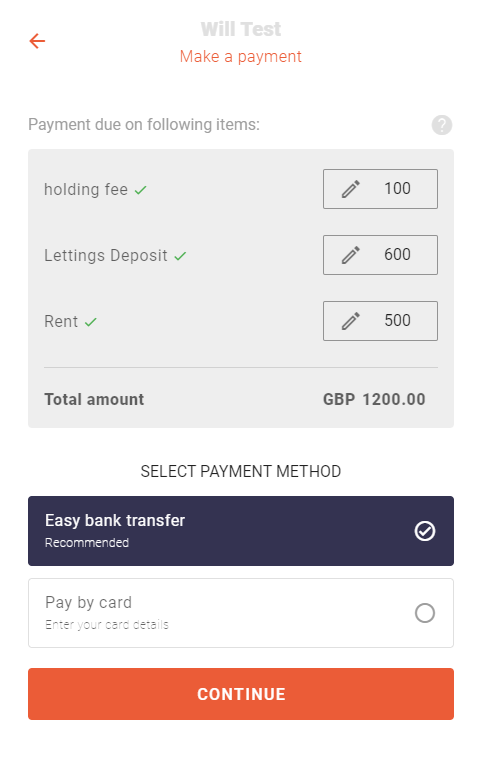

When you click through, you'll get this pop-up, allowing you to select which bank account the payment will be sent to, and the amounts that you'd like to request. If you are requesting a payment from a tenant then any Outstanding Deposit or Outstanding Rent will be populated in here automatically, although you can change these figures if needed:

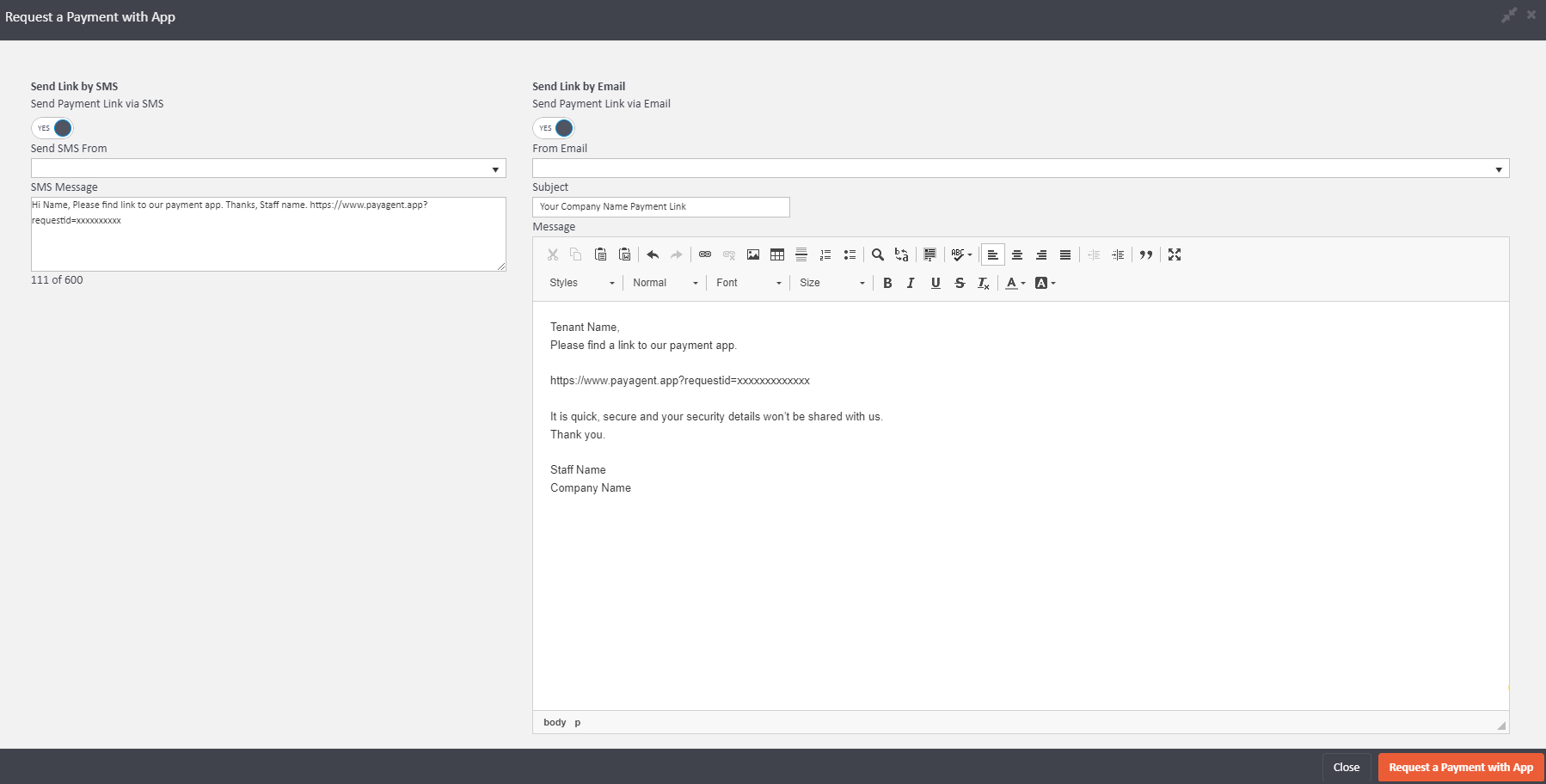

This will then load an Email and SMS sending screen, allowing you to amend details if needed and send these requests out.

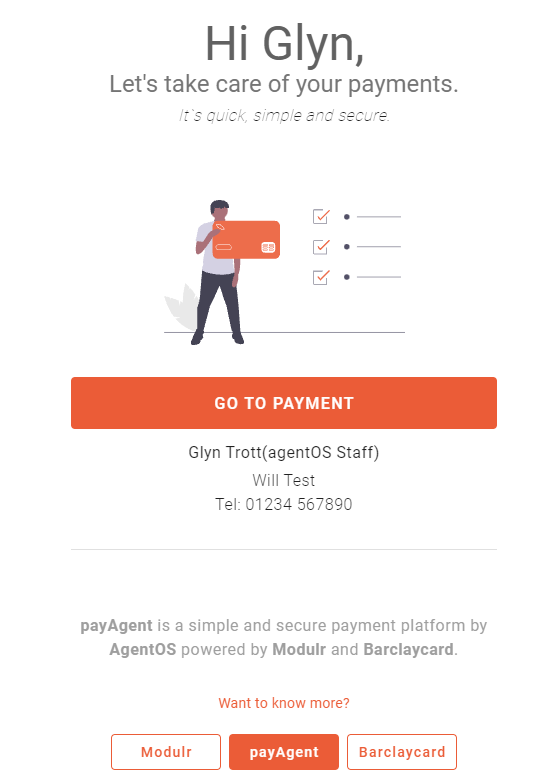

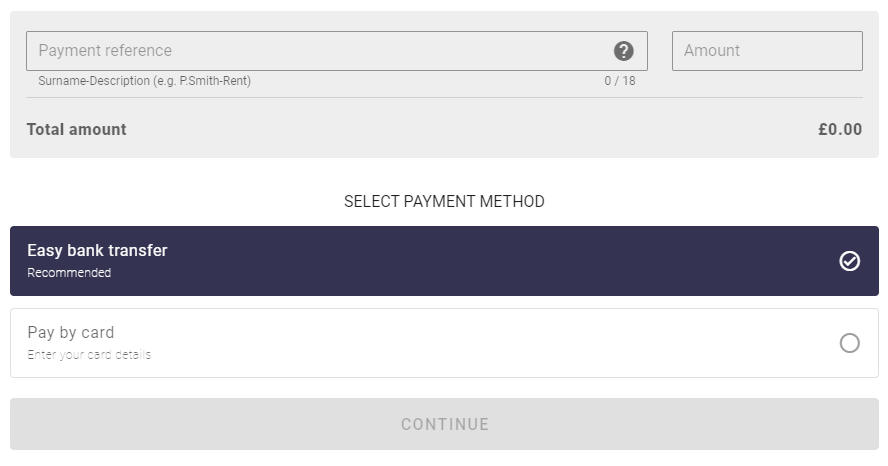

Those receiving a payment request will have the option of selecting the amount to pay and the payment method, either by bank transfer or by card payment:

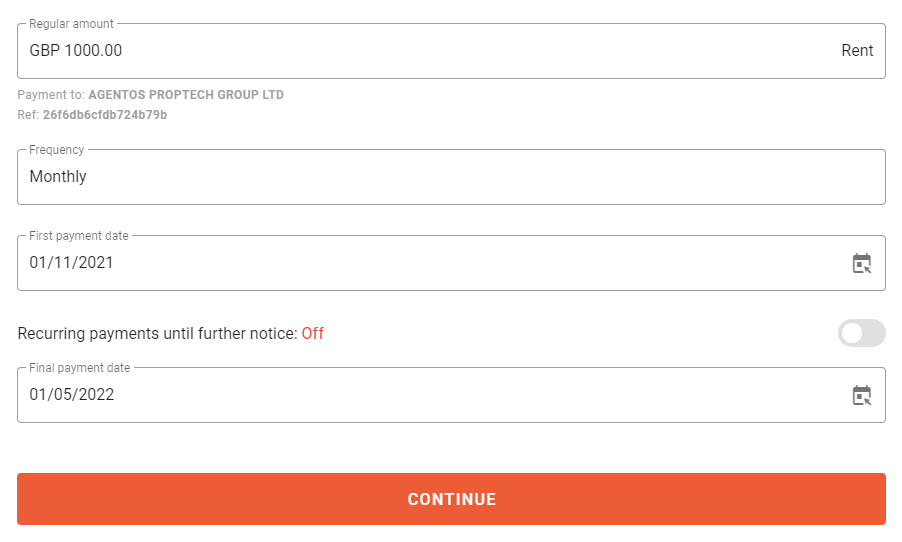

For Standing Orders, your clients can select an amount, frequency and both the first and final payment date as required, or make recurring payments until further notice:

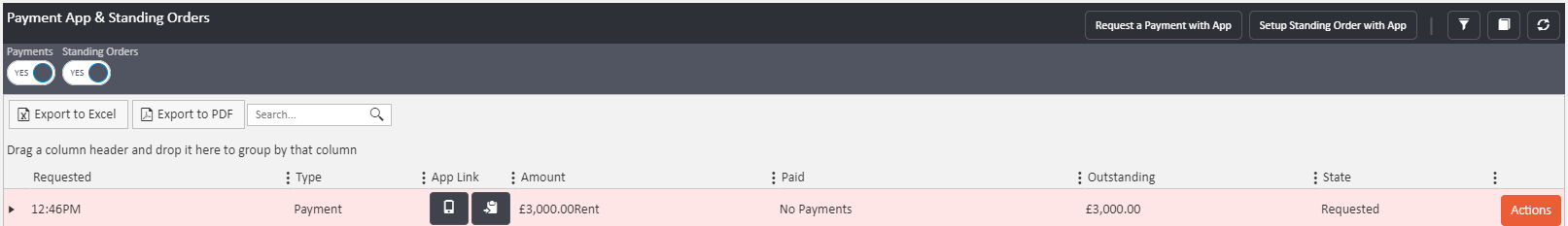

Back on agentOS, any payments requested will then show in the Payment App & Standing Orders grid, updating as your payee sends their funds to you:

If you need to re-send a request, or you need a copy of the link to send through a different method, you can do this by clicking the buttons in the App Link column here.

Clicking the arrow to the left of the requested payment will give you more information in the Log, including updates of when the payment processes through.

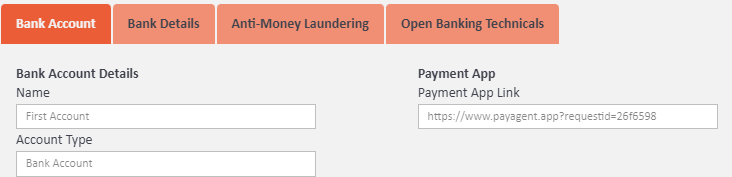

You also have the ability to send generic payment links out, where the recipient can specify a one-off payment and enter their own reference. You'll find the unique link for each bank account inside your Bank Account details, under Payment App Link:

When your recipient clicks through to the link, they'll see this form to complete with reference and amount details. Be sure to get them to enter a memorable reference so that you can find the payment later on:

Comments

0 comments

Article is closed for comments.